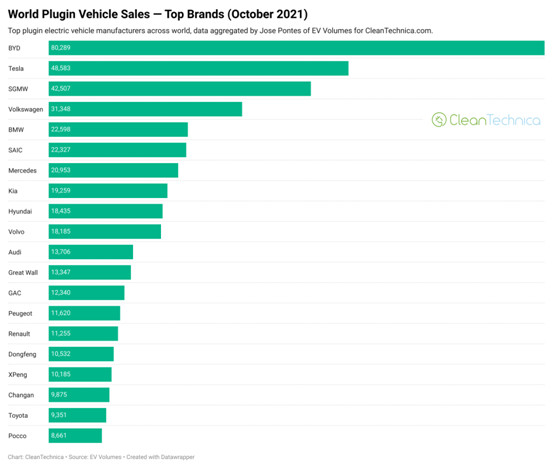

In October, BYD’s never ending ramp up had another chapter, clocking over 80,000 units. It seems the Shenzhen automaker is adding some 10,000 units to its output every month, so we might see it reach 6 digits by December. For now, the new record was enough to grant it the Best Seller title in October, and volume-wise, BYD’s numbers placed it close to Tesla’s own quarterly average in Q3, 80,433 units/month.

The following positions haven’t brought any surprises, but in #8 we have Kia landing a record score (19,259 registrations). Added to the near-record performance from #9 Hyundai, that made the Korean OEM one of the winners of the month — mostly thanks to the Ioniq 5 and EV6, which provided that extra volume to what are already very consistent lineups. We might have these two aiming for top 5 presences soon.

But the main trend is the rise and rise of the Chinese brands. Adding together the share of the 9 Chinese brands in this top 20, they make up 36% of all plugin vehicles registered last month.

The surprise among them is the #20 Pocco, a little known brand focused on making small EVs which only landed five months ago — and has already debuted in the top 20. Of the current two-model lineup, the little Duoduo four-seater looks particularly interesting, like a quirky kei car out of Japan. The small EV has Wuling Mini–like specs and pricing (14 kWh battery, 100 km/h max speed, ~$5,400 USD), but is served in a (slightly) larger body with 5 doors. With a third model set to land soon, the Lala mini-MPV, Pocco could be another surprise coming from China.

And below the table, there are more Chinese automakers (NIO, Li Xiang, Hozon, Weltmeister, Chery, etc.) that could make a top 20 presence soon, so it should only be a matter of time until this global top 20 list has a majority of Chinese brands.

In the YTD table, there wasn’t much to report in the top positions — #2 BYD distanced itself from #3 SGMW, and … that’s it when comes to the top half of the table.

To see positions changes, we have to go to the second half of the table. There, Peugeot has surpassed Toyota and is the new #13, while GAC was up to #16 and Changan is now #18.

XPeng joined the table in #20, making it the 8th Chinese brand in the ranking. NIO is now fewer than 6,000 units ahead of XPeng, so the race between these two ambitious Chinese startups is one of the few interesting things to follow until the end of the year. By now, the top table positions are already firmly in the hands of their owners.

Note: a BEV-only version of this chart/ranking will be provided at the end of the quarter.

Looking at registrations by OEM, Tesla dropped one share point compared September, but should recover it in the next two months of the quarter, ending the year with 15% share, one point less than in 2020 and 2 points less than in 2019.

The remaining OEMs retained their standings and shares, but expect BYD to pressure SAIC in December — we might still have a surprise in the last place of the podium.